This blog is part of our Growing the Evidence series, which contains evidence and insights uncovered by Mathematica’s researchers in the international food and agriculture sector.

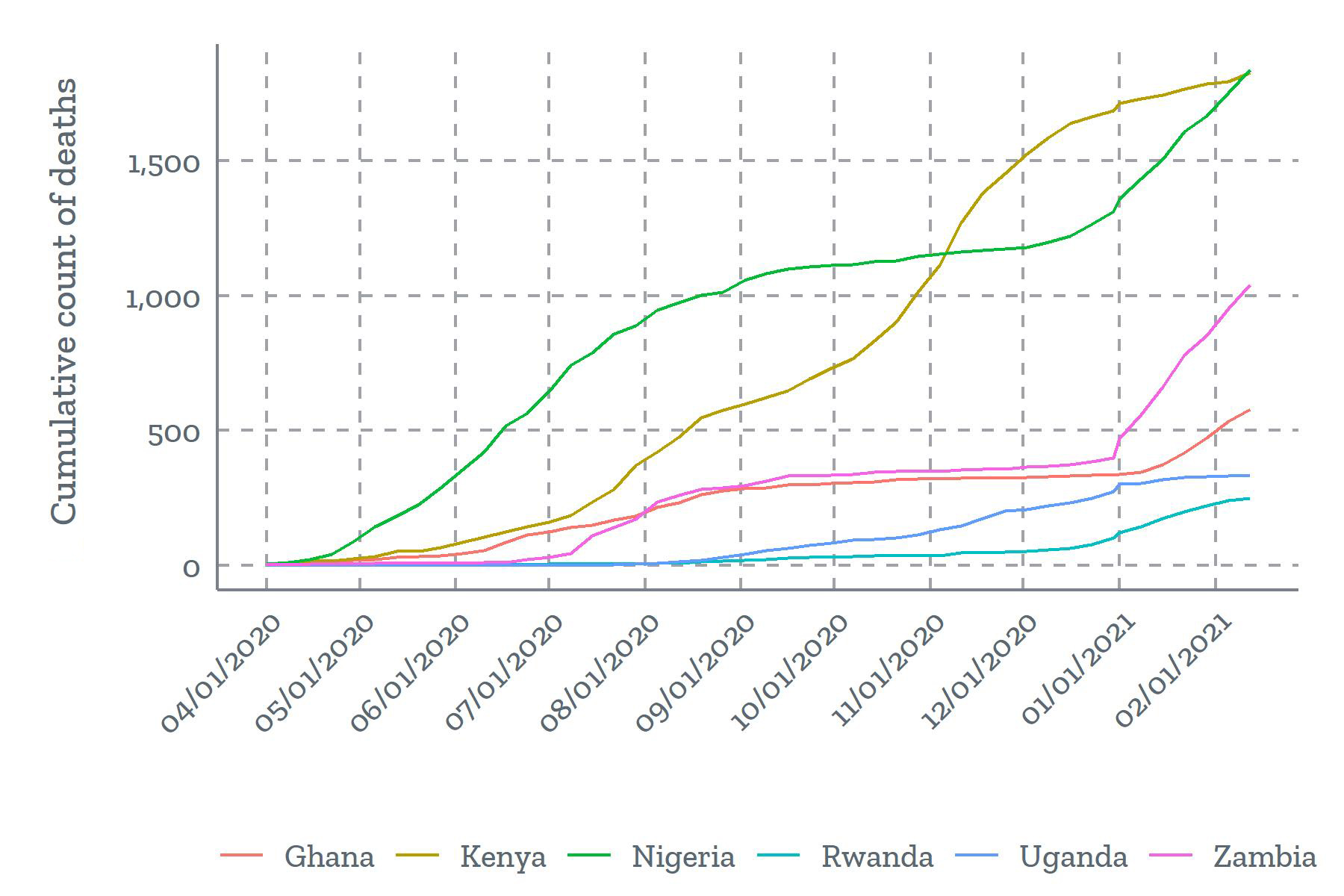

Since the World Health Organization declared COVID-19 a pandemic on March 11, 2020, global COVID cases and COVID-related deaths have been increasing. Although sub-Saharan African nations have had lower a prevalence of COVID and commensurate deaths, recent data from seven African countries suggest that COVID-19 deaths have stabilized in some countries but are still increasing in others. There is a stark difference in deaths between South African and sub-Saharan economies, similar to differences between developed and developing countries. This discrepancy remains a puzzle and the topic of many articles, including one by Dr. Siddhartha Mukherjee.

Figure 1. COVID-19 deaths in African countries

More than a year later, the promise of vaccines to further limit COVID deaths has been tempered by sluggish vaccine availability in sub-Saharan countries. Even as African countries prioritize vaccination distribution, Africans remain concerned about the spread of the South African COVID variant, which has shown signs of resistance to at least one of the vaccines appropriate for use in developing countries.

In addition to a tragic death toll, the pandemic has had a dramatic economic impact. The International Monetary Fund (IMF) estimates that sub-Saharan African economies experienced a negative 2.6 percent growth rate in 2020, with hopes of it nudging back to a positive 3.2 percent growth rate in 2021. Looking more closely at individual countries, the IMF estimates that the South African economy contracted by 7.5 percent in 2020, in part because of COVID mitigation measures. Low oil production and low oil prices along with tepid domestic demand because of the lockdown meant that the economy shrunk by 3.2 percent in Nigeria.

These estimates, although disappointing, are slightly improved from the last forecast because of the early development of vaccines. But they are somewhat dampened by the surge of new variants. Although IMF’s estimated 2020 growth rate is not available for all other countries, it is likely that the latest forecast for 2020 growth rates will largely hold. Zambia’s economy is projected to contract by 4.8 percent, while Uganda’s is projected to contract by only 0.3 percent. The Rwandan economy, which depends on non-oil commodity exports, on the other hand, is expected to grow by 2 percent, down from 9.4 percent in 2019. Ghana and Kenya are also projected to hold onto positive growth rates of 1 percent in 2020, bolstered by strengthening domestic and international demand.

These numbers might tell the story of the damage done to these economies. But they can’t begin to capture the toll that this pandemic has taken on millions of families and businesses across sub-Saharan Africa. And they do not offer insight into the massive changes that people living in these countries have gone through over the past year. With countries transitioning from strict lockdowns to opening up cautiously amid a persistent pandemic and considering additional lockdowns to limit the spread of new variants, we must look beyond measures like gross domestic product to uncover insights about how people in sub-Saharan Africa have fared in these turbulent times.

We are able to uncover this story using data from FinMark Trust, which worked with GeoPoll to field high-frequency surveys. These surveys asked respondents in Ghana, Kenya, Nigeria, Rwanda, Uganda, Kenya, and South Africa a range of questions about how the pandemic was affecting people. The survey was conducted in two-week intervals beginning in late April and running through mid-October 2020. Using an innovative approach to weight the telephone-based surveys, Mathematica uncovered insights from multiple rounds of these surveys by creating nationally representative estimates in each round.

The data reveal important findings regarding access to services and mobility restrictions, families’ coping mechanisms, and early impacts on food security and income.

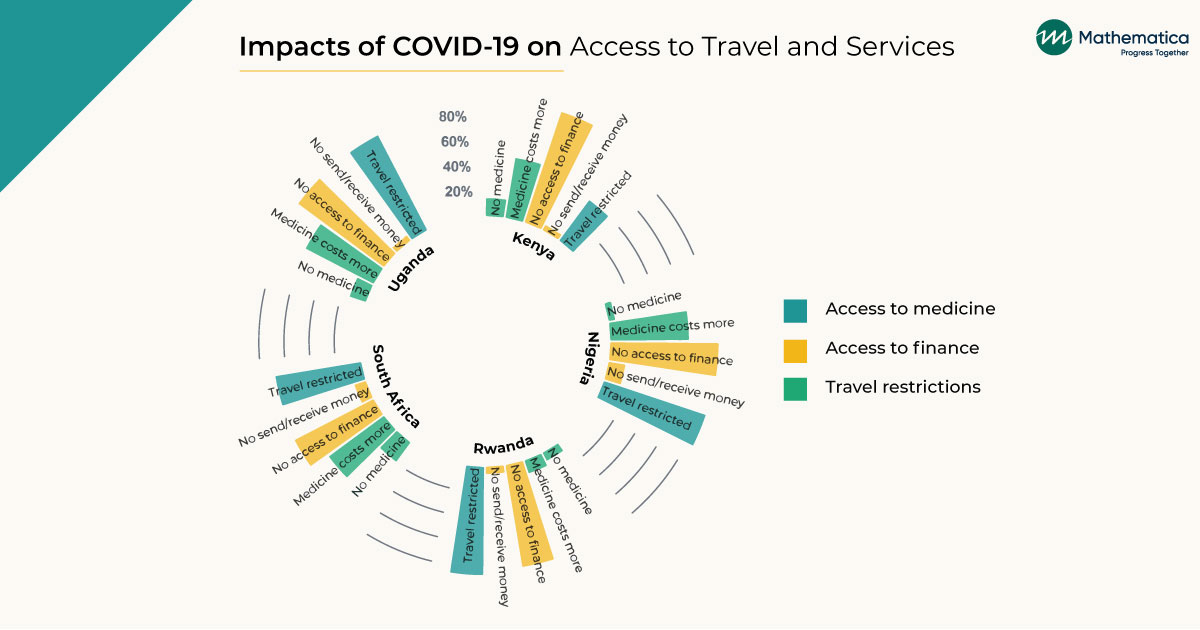

Access to services

Between April and October 2020, households in all countries except Zambia showed improvement in their ability to finance their needs. However, the percentage of households reporting no access to financial resources by October 2020 remained high. In Ghana, 63 percent of households reported no access to financial resources—the lowest percentage among the countries surveyed—while Kenya had the highest percentage at 78 percent of households. In Zambia, the percentage of households reporting no access to financial resources increased from 63 percent in May 2020 to 76 percent in October 2020.

The percentage of households reporting higher medicine costs increased in all seven countries from April to October 2020. A much smaller percentage of households reported that they were unable to access medicines entirely. However, this percentage increased over the reporting period. Throughout this period, there was a lot of variation in households’ ability to access medicines across countries. The percentage of households reporting no access to medicines ranged from 8 percent in Rwanda to 28 percent in Zambia in October 2020.

Households’ ability to send and receive money also declined over this time period in most countries. However, the percentage of households facing this difficulty remained low. By October 2020, the percentage of households reporting an inability to send or receive money was greater than 15 percent in only Nigeria and South Africa.

Figure 2. Households’ access to services (late April to early May)

|

Scroll right to view

all countries

No medicine

Medicine costs more

No access to finances

No send/receive money

|

Kenya |

Nigeria |

South Africa |

Rwanda |

Uganda |

Zambia |

Ghana |

Coping mechanisms

A positive story emerging from this high-frequency data is that in all seven countries, nearly three-fourths of the households reported wearing face masks by October 2020. Some countries saw dramatic increases in the use of face masks. For example, only 22 percent of households in Uganda reported using face masks in April 2020 compared with 76 percent in October 2020.

Unsurprisingly, the percentage of households staying at home declined over time as economies opened up, with a minority of households reporting staying home by the end of the reporting period. Even as people were stepping out of their homes, they were being cautious about traveling outside their cities. Most households continued to report that they did not travel in the previous two weeks, even though this number declined a bit over time. In addition, the percentage of households reporting that they were avoiding groups increased in Ghana, Kenya, Nigeria, and Uganda, and decreased in Rwanda, South Africa, and Zambia.

In response to the adversities posed by COVID-19, a greater percentage of households reported the need to borrow money or miss loan repayments over time. At least one-fifth of households in Kenya and Uganda reported missing loan repayments by October 2020.

Figure 3. Household social-distancing response and coping strategies

|

Scroll right to view

all countries

Seek med care if sympts

More hand sanitizer

Wear face mask

Avoid big groups

Stay at home

No travel last 14 days

Missed repaying loan

Borrowed recently

|

Kenya |

Nigeria |

South Africa |

Rwanda |

Uganda |

Zambia |

Ghana |

Food security and income impacts

Expectedly, in Ghana, Kenya, Nigeria, Rwanda, Uganda, and Zambia, more than 50 percent of the households reported lower earnings between April and October 2020 compared with before the pandemic. By mid-October, more than 80 percent of householdsall countries except Ghana and South Africa reported reduced income.

Households also reported having less food available and eating fewer meals for more than two days of the week. More households reported skipping more than two meals per week in Nigeria and Zambia, with Nigeria facing the sharpest increase. In Nigeria, the percentage of households eating fewer than two meals per week increased from 28 percent in late April to 66 percent in mid-October. The food security outcomes are consistent with the larger contraction of these economies during the crisis. In Kenya and Uganda, the situation worsened only slightly; all other countries reported an improvement on this metric over the time period, which is consistent with their positive or near positive (in Uganda) economic growth in 2020.

Figure 4. Impacts of COVID on income and food security

|

Scroll right to view

all countries

Reduced income

Less food availability

Not eat > 2 meals/week

|

Kenya |

Nigeria |

South Africa |

Rwanda |

Uganda |

Zambia |

Ghana |

High-frequency data highlight troubling trends in households’ economic and food security status. Through these difficult times, people are doing the best they can by using face masks and hand sanitizers and limiting travel. They are resorting to skipping loan repayments and borrowing money but also facing high medicine costs. As we enter the second year of this global pandemic, sub-Saharan countries need to continue aiding families and simultaneously think about increasing their resilience to such shocks in the future. The most immediate need is to ramp up delivery of COVID-19 vaccines.

The data used in this blog is derived from the COVID-19 tracker phone survey that FinMark Trust conducted with GeoPoll in seven countries across sub-Saharan Africa. Mathematica provides analytical support to the project by cleaning and weighting the raw survey data to create nationally representative estimates; we then apply multilevel regression with post-stratification to enable analysis for subgroups of interest, such as women and rural populations. The survey includes about 75 questions and was administered every two weeks, starting in April 2020 and ending in mid-October.

Seek med care if sympts

More hand sanitizer

Wear face mask

Avoid big groups

Stay at home

No travel last 14 days

Missed repaying loan

Borrowed recently

No medicine

Medicine costs more

No access to finances

No send/receive money

Reduced income

Less food availability

Not eat > 2 meals/week

|

Kenya |

Nigeria |

South Africa |

Rwanda |

Uganda |

Zambia |

Ghana |